What’s going on with Commercial Real Estate interest rates?!

February 3, 2025

What’s going on with Commercial Real Estate interest rates?!

One topic that is on every commercial real estate (CRE) owner and investor’s mind right now is interest rates, especially in light of the Federal Reserve cutting the Federal Funds Rate.

What is the Federal Funds Rate?

The Federal Funds Rate is the interest rate at which banks lend money to each other overnight to meet reserve requirements. The Federal Reserve sets a target Federal Funds Rate to control the cost of short-term borrowing. This rate then has some influence over other borrowing rates such as 30-year mortgage rates and Treasury rates. Those in the CRE industry are interested in the Fed Funds Rate because the cost of borrowed money is based on a spread over a benchmark interest rate like the 5-year US Treasury, and those benchmark rates are at least somewhat connected to the Fed Funds Rate.

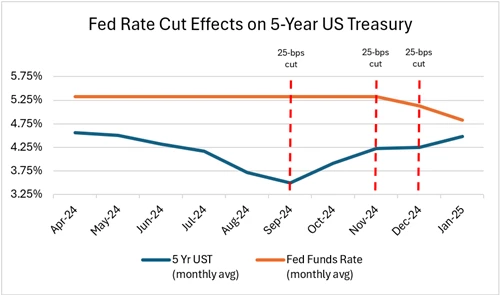

However, the common belief that the Fed Funds Rate and borrowing rates move in the same direction and by the same amount has been challenged recently. Despite the Fed cutting its rate in September, November, and December 2024, borrowing costs have increased in subsequent months.

How often do rates change?

If you’re wondering if this has happened before, the simple answer is yes! In fact, what is happening now regarding rates is more common than you may think. Reviewing your options with your lender is the first step in ensuring your project stays aligned with your goals as rates fluctuate.

The chart below illustrates the most recent Federal Reserve Rate cuts and their effects on the average monthly 5-year US Treasury rate. During the months leading up to the first Fed rate cut in September 2024, the average 5-year US Treasury rate decreased. Since that first Fed rate cut and two additional rate cuts, the 5-year has increased every month. In our historical analysis of the 2008, 2019, and 2020 interest rate cut cycles, the months leading up to the Fed Rate cut saw decreases in the average monthly 5-year US Treasury. In 2020, the following months saw a slight decrease in the 5-year rate, but in 2008 and 2019, the subsequent months resulted in a 5-year US Treasury rate increase.

Source: Federal Reserve Economic Data | FRED | St. Louis Fed

* January 2025 average is from 1/1/25 through 1/14/2025.

While conventional wisdom suggests Treasury rates follow the Federal Funds Rate, the data from the most recent cuts and historical data shows a more nuanced effect. The expectation of a rate cut more closely correlates with a drop in the 5-year US Treasury, with post-cut months often seeing an increase that sometimes matches the prior decrease. Understanding this historical data can help CRE professionals understand how the Fed Rate cuts may affect borrowing costs.

What to expect in 2025

If your goal is to purchase commercial property in 2025, understanding the Federal Funds Rate is important. Market analysts speculate that in 2025, the Fed will make two 25 bps cuts. As the Fed signals to lower rates, the 5-year yield might initially drop in anticipation of cuts and then bounce back up to the level it was at before. However, the economy is complex, making it challenging to predict the future movement of any single economic variable.

By Shayna Jennings, Commercial Real Estate Market Analyst

About Shayna:

Shayna Jennings is an analyst for Kearny Bank’s Commercial Real Estate Lending Department. Her role involves preparing and maintaining reports, conducting in-depth research, and providing analytical support. Shayna assists with the administration of the construction loan portfolio and maintains the construction loan database. She also supports the Commercial Real Estate Lending Department by tracking incoming leads, reviewing financial feasibility, and performing portfolio management duties. Shayna holds a bachelor’s degree in economics from Oberlin College.